Happy Sunday Macros,

ESG has taken a ton of heat in the press and across the broader economy over the last few months. Some of it is warranted, but a lot of it is due to the misunderstanding from where ESG comes from. I certainly don’t have all the answers, but having worked in the space for a while, I was interested to take a deeper dive into the concepts behind ESG and the historical context for where they came from.

If you don’t have time to read the full piece, here are the three takeaways:

ESG comes from a principles-based investing approach where people buy things aligned with what they stand for. Investors do the same. These values change over time.

People invest where they can get a good return and increasingly where they can get a social return based on those values.

Measuring impact and sustainability is hard. People across the world are hard at work doing this. It’s my view having standardized measures like that of GAAP (Generally Accepted Accounting Principles) for financial accounting can help benchmark, compare, and clear markets.

MacroDive

History of Values-Based Investment

While this synopsis is a quick look at history, let’s rewind the clock to the 1700s. Before the term “ESG” was coined, there were specific standards for investment based on moral and religious values. Early value-based investment could be seen, “[i]n the 1700s with Quakers and Methodists in the United State and Europe who would exclude slave labor from their investment practices.”1 This became widespread over time, but it started with specific investors choosing to allocate capital outside of the slave trade, in effect divesting from practices they thought to be morally wrong and corrupt. Quakers famously owned slaves throughout their history, but over time, divested from this practice to align with their evolving values.

Skipping ahead to the 1960s there was a growing movement for divestment from Apartheid South Africa before it came to a head in the 1980s. This divestment was due to broad political pressure and aggregate demand choosing to not invest in a region that supported Apartheid. Putting your money where your mouth is has been central to the investment process throughout time, depending on how values and moral codes change and evolve. People simply determine what is right and wrong based on history, based on the current climate, and make investment decisions accordingly.

Governments didn’t tell people what to think or mandate what was right and wrong. Most times, governments respond to what the aggregate demand is of the time; this was true 300 years ago, and it’s true today.

ESG in its current framing

Values- based investing is one thing, but who came up with the term ESG and where did this concept come from in its modern form? The term was first used by the United Nations Environment Programme Initiative in 2005 after the 'Triple Bottom Line' concept first appeared the the 1990s. This was developed and supported by 154 countries at Rio de Janeiro for the United Nations Framework Convention on Climate Change (UNFCCC). This legislation was developed by the UN in response to customers and investors demanding a response from the growing scientific evidence of global warming from humans.2

The years following showed a direct increase in ‘ESG’ designated investing funds, in response to what is perceived to be the most pressing issues of our time. 300 years ago, the Quakers and Methodists saw slavery as the most pressing issues of our time and voted with their money to not support it. Today, we see investors doing the same with greenhouse gas intensive industry. While the debate around what is the most important rages on, having metrics that give customers and investors information about the social and environmental impact of products and services is allowing for more perfect information in markets, magnifying what used to be market externalities into a priced market.

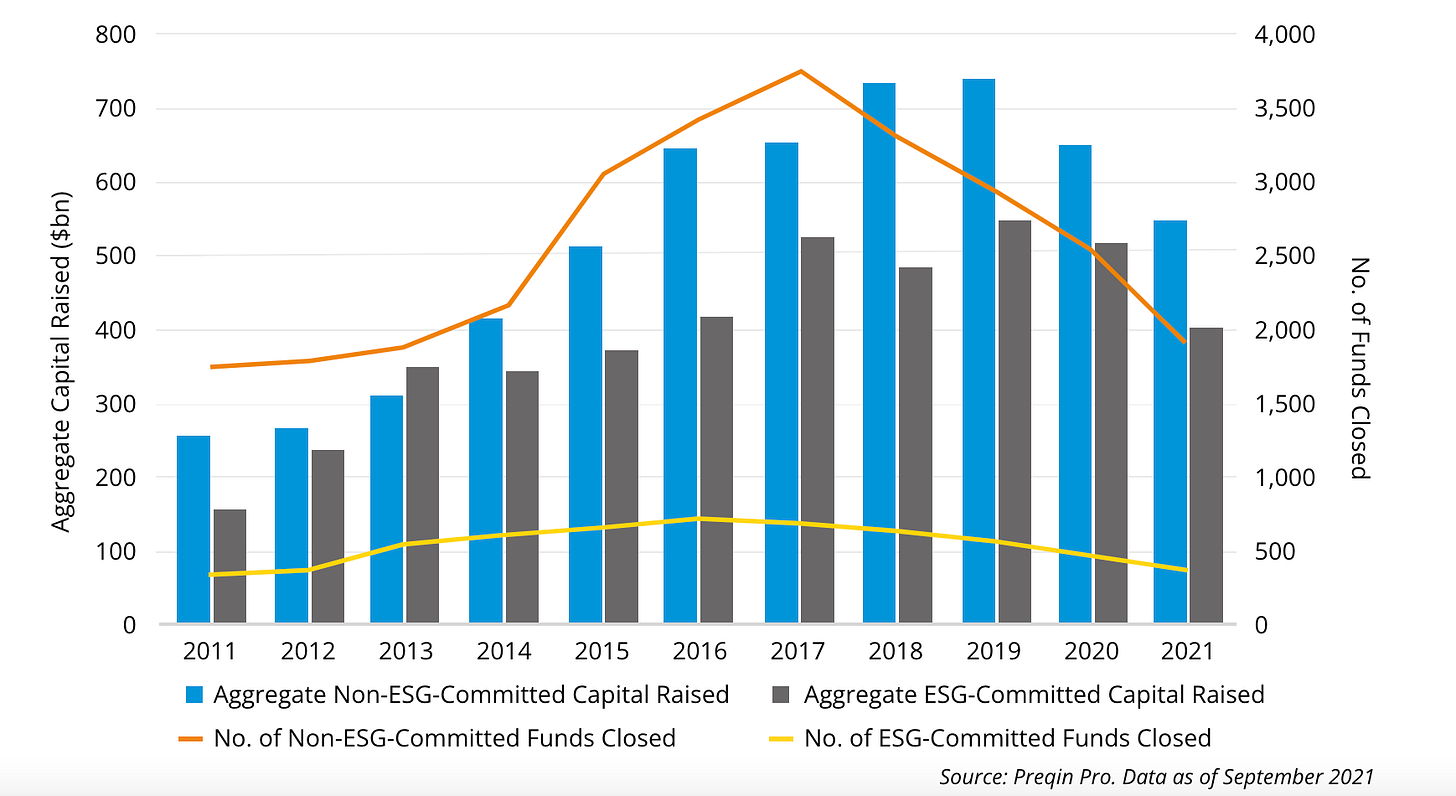

This chart from Preqin shows the amount of the Private Capital fundraising under ESG Commitment:

ESG is becoming a concise way to organize social and environmental issues so that capital allocators have more information about their investment than ever before. The process by which this data collection is an ongoing issue, but over time this will be improved and streamlined so that reporting these issues will be analogous to financial reporting.

Rankings and methodologies aside, the raw data that is provided by these new frameworks and metrics gives more insight into a company’s operations. Its long term viability from a financial point of view can be affected by some of these metrics. For example, if there are large monetary losses due to incidents of corruption (a popular G metric), this could be a material risk for investors. Having insight into this metric is probably an important piece of diligence before allocating a substantial amount of capital. This could show greater corruption within an organization that is existential in nature and would stymie future financial returns.

This increased visibility into non-financial metrics and risks is a net-positive for investors. While it’s not perfect in its current form, it’s important to start somewhere. Starting shows courage, and a commitment to find the truth that aligns to the values of the world right now. The process will get better, and over time, it will become easier to interpret and understand these non-financial metrics with a long-term outlook.

Conclusion

One of the biggest critiques of the current ESG movement is that it is a group of ‘woke’ people forcing their views of the world on business and society. While ESG has been misinterpreted by those on the left and right, it simply is a concept that was constructed to simplify the growing demand from society to include new values and moral codes into the investment process. This is a tale as old as time, so let’s figure out how to improve the process and move humanity forward.

MacroQ

What does investing provide you?

https://www.preqin.com/preqin-academy/lesson-5-esg/history-of-esg

https://www.esganalytics.io/insights/where-did-the-term-esg-come-from-anyway